Beijing, July 9 (Reporter Xie Yiguan) The performance of A shares has kept 160 million investors "excited".

After a lapse of five years, the turnover of A-shares once again exceeded one trillion for five consecutive days, and the Shanghai Composite Index rose by more than 400 points in just seven trading days, an increase of nearly 15%. "Is the A-share bull market really coming?" has therefore become a hot topic this week.

Why does the stock market continue to soar in the context of economic development being hit by the epidemic? What are the funds that drive the stock market to rise?

The daily K-line chart of Shanghai Composite Index.

The Shanghai Composite Index rushed to 3,400 points, and the Growth Enterprise Market Index returned to 2,600 points.

After several days of hot market, the market became calm on the 8th. The three major A-share stock indexes were mixed at the opening, and the intraday trading fluctuated widely, and the performance of the industry sector was divided. Driven by the resurgence of brokerage stocks, the market rose late, and the Shanghai Composite Index closed above 3,400 points.

At the close, the Shanghai Composite Index rose 1.74% to 3,403.44 points, achieving "seven consecutive gains"; The Shenzhen Component Index rose 1.84% to 13,406.37 points; The GEM index rose 2.34% to 2,651.97 points, returning to 2,600 points.

On the disk, a total of 3,124 stocks in the two cities rose and 180 stocks rose daily; 539 stocks fell and 7 stocks fell.

The style of the plate changed rapidly, and the ship and aviation plates led the market, rising by more than 9%. The big finance that had been adjusted back before picked up, and the securities, insurance and diversified financial sectors were among the top gainers; The brewing sector, which led the gains on the 7th, closed down against the market on the 8th.

In terms of concept plate, gambling concept, digital currency, rare earth permanent magnet and other plates performed brilliantly. The concept of national defense and military industry lifted the daily limit, and 32 related stocks such as Dongfang Electric Heating, Tongguang Cable and Guangdong Ganhua closed the daily limit.

The national defense military sector has some daily limit stocks.

The market sentiment continued to rise. On the 8th, the turnover of A shares reached 1.5 trillion yuan, which was rarely exceeded for five consecutive days. Recently, many brokerage apps even have a stuck situation. Alibaba Cloud also confirmed to the reporter of Zhongxin. com: Recently, due to the sudden increase in the trading volume of the stock market, Alibaba Cloud has received the expansion needs of many brokers to solve the problems such as data delay and transaction jam of brokerage APP.

Who is taking money to enter the market?

Who is entering the market with a turnover of over one trillion yuan? At present, individual investors, foreign capital and funds are the main forces, while industrial funds have been reduced.

— — The balance between the two companies soared continuously, exceeding 100 billion in five days.

Recently, the number of accounts opened by investors in securities firms has increased greatly, and the balance of margin financing and securities lending in the stock market has also continued to soar. As of July 7, the balance of A-share margin financing and securities lending was 1,268.546 billion yuan, an increase of 26.717 billion yuan over the previous trading day. In the five trading days in July alone, the cumulative growth exceeded 100 billion yuan.

The financing balance of some companies has increased significantly. According to Wind’s statistics, on July 7, the financing balance of 27 stocks increased by more than 15%, and the latest financing balance exceeded 200 million yuan, accounting for more than 1% of the circulating market value.

"The yield of bank wealth management products is declining, and residents’ deposits have a strong willingness to move into the market. The era of residents’ assets embracing big rights and interests has arrived." Wu Chaoming, vice president of Caixin Institute of International Economics, said.

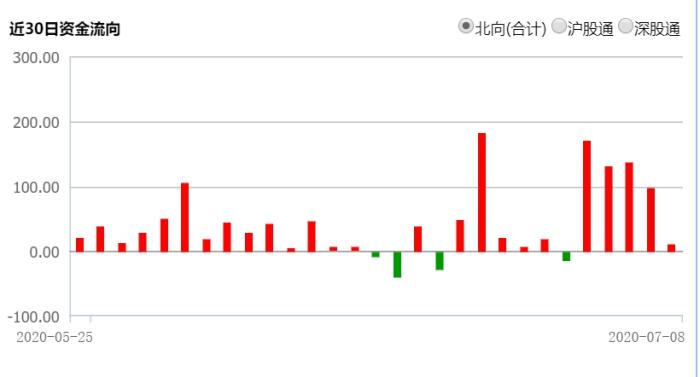

— — Foreign capital continued to scramble for funds, and the net inflow in five days exceeded 50 billion.

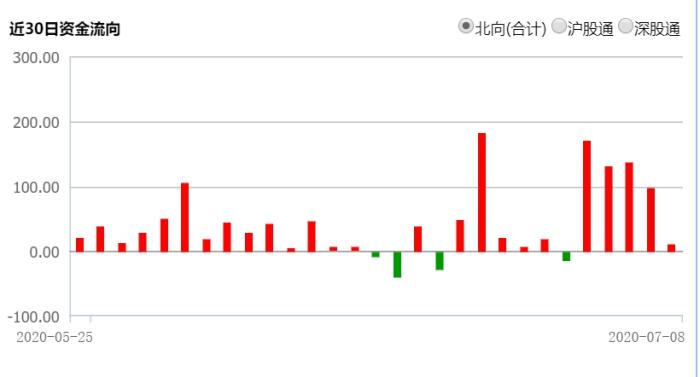

The A-share market has also been continuously optimistic about foreign capital. On the 8th, northbound funds bought 1.153 billion yuan in a small amount, which was a net purchase for five consecutive days, and the net purchase amount was significantly narrowed compared with the previous four days. However, since July, the total net inflow of foreign capital has reached 54.958 billion yuan, which has exceeded the total net inflow of northbound funds in June.

"In the context of continuing to maintain loose money and extremely low interest rates around the world, the core assets of A-shares are still medium-and long-term foreign investment." AVIC Securities believes.

Capital flows northwards in recent 30 days.

— — New funds often exceed 10 billionscaleThis year, the total fundraising has exceeded one trillion.

Under the heat of the market, a number of fund companies recently launched heavy products, raising more than 10 billion. Take Huitianfu’s mid-cap value selection hybrid securities investment fund, which was launched on July 6th, as an example. Its initial raising scale is about 69.25 billion yuan.

Wind data shows that as of July 5, 687 new funds have been established this year, with a total fundraising scale of 1.077 trillion yuan, which makes 2020 one of the three years in which new funds raised more than one trillion yuan, before 2015 and 2019.

On the 8th, the survey report released by Tencent Licaitong showed that equity funds are the main way for residents to allocate potential high-yield assets such as stocks. When considering the allocation of growth assets, 44.4% of the respondents chose hybrid funds, 37.9% chose stock funds and 20.8% chose stock index funds.

According to Liu Mingjun, chief investment expert of Tencent Financial Technology Think Tank, the performance of equity-based Public Offering of Fund is bright this year, and the average yield of equity funds and partial-stock hybrid funds in the first half of the year is around 20%.

— — Off-exchange fund-raising took off, and industrial capital "fled"

In addition to formal channels, off-site fund-raising has also made a comeback, with 10 times benchmark fund-raising taking the lead.

When other funds came into the market, industrial capital began to "flee" recently. According to media statistics, on the evening of July 6 and July 7, a total of 36 listed companies in Shanghai and Shenzhen stock markets disclosed their shareholder reduction plans, involving 59 important shareholders, with a total planned reduction of about 7.024 billion yuan.

Why are shareholders of listed companies busy reducing their holdings when the market continues to soar? From the reasons for the disclosed reduction, there are reasons such as personal capital demand, business development needs, the partnership entering the exit period and returning the stock pledge, among which personal capital demand accounts for the most.

Data Map: Shareholders in a securities business department pay attention to the market trend. China News Service reporter Zhang Lang photo

Why did the stock market rise continuously?

The triumph of the stock market has also attracted great attention from netizens. "Is the A-share bull market really coming?" has become a hot topic for several days. As of the evening of July 8, the number of readings on this topic has exceeded 460 million, and more than 15,000 people have participated in the discussion. Among them, some netizens questioned, "The economy is so affected by the epidemic, why is the stock market rising so much?"

Under the impact of the epidemic, China’s GDP in the first quarter decreased by 6.8% year-on-year, the lowest since the quarterly GDP was announced in 1992. The "troika" of consumption, investment and export all experienced negative growth, with a year-on-year decrease of more than 10%.

The economic report card for the second quarter has not yet been published, but according to the data of the National Bureau of Statistics, from January to May, the investment decline narrowed for three consecutive months, and the national fixed asset investment (excluding farmers) decreased by 6.3% year-on-year. In May, the decline in total retail sales of social consumer goods narrowed by 4.7 percentage points from the previous month, down by 2.8% year-on-year.

The reporter from Zhongxin. com found that although the impact of the epidemic on the economy is an objective fact, research institutions and economists believe that the stock market is a "barometer of the economy" and the stock market rise is based on good expectations for economic growth under the economic recovery.

"Recently, the A-share market has been enthusiastic, and the Shanghai Composite Index has hit a new high in the past two years. It stems from the fact that domestic epidemic prevention and control and economic recovery are at the forefront of the world’s major economies, and the economic fundamentals are full of resilience." Wu Chaoming, vice president of Caixin Institute of International Economics, said.

In June, the purchasing managers’ index (PMI) of China’s manufacturing industry was 50.9%, up 0.3 percentage points from the previous month, and it was higher than that of threshold, where it was 50% for four consecutive months. Usually, when the PMI changes in the same direction for more than three consecutive months, it reflects the trend change of economic operation and shows that the manufacturing industry is recovering steadily.

A few days ago, the International Monetary Fund (IMF) released the latest World Economic Outlook, which predicted that the global growth rate in 2020 would be – 4.9%, 1.9 percentage points lower than the forecast in April. At the same time, however, the IMF expects China’s economic growth rate to be 1.0% in 2020, making it the only country with positive growth in its forecast table.

"China’s economy is recovering from the sharp contraction in the first quarter, thanks to policy stimulus to some extent." The IMF said.

Pan Xiangdong, chief economist of New Era Securities, told Zhongxin.com that after the outbreak, China’s monetary policy was loose, the price of funds among financial institutions was low, the growth rate of M2 and social financing rose sharply, the macro liquidity was abundant, China’s economy recovered well, the PPI growth rate bottomed out and corporate profits improved. "Since the end of March, the upward movement of the market center has attracted social funds to enter the stock market, and the recent increase in the issuance scale of partial stock funds is proof."

"Investors, especially small and medium-sized investors, should adhere to the concept of rational investment, not only have full confidence in the development of China’s economy and capital market, but also recognize the risks and uncertainties of the market." Wang Xian, vice president of Tsinghua University National Finance Research Institute and director of the research center of listed companies, said that the decision-making should be based on the concept of long-term value investment, and should not be excessively disturbed by short-term emotions or excessively pursue short-term trends. (End)