In the past two years, domestic beauty products have ushered in a "listing tide" in full swing. In October 2020, Pien Tze Huang launched the cosmetics business listing plan; In November, Perfect Diary’s parent company, Yixian E-commerce, was listed on the New York Stock Exchange, becoming the "first share of domestic beauty products" listed overseas; In March 2021, Winona’s parent company Betani went public.

Source: 2021 Beauty Industry Trend Insight Report

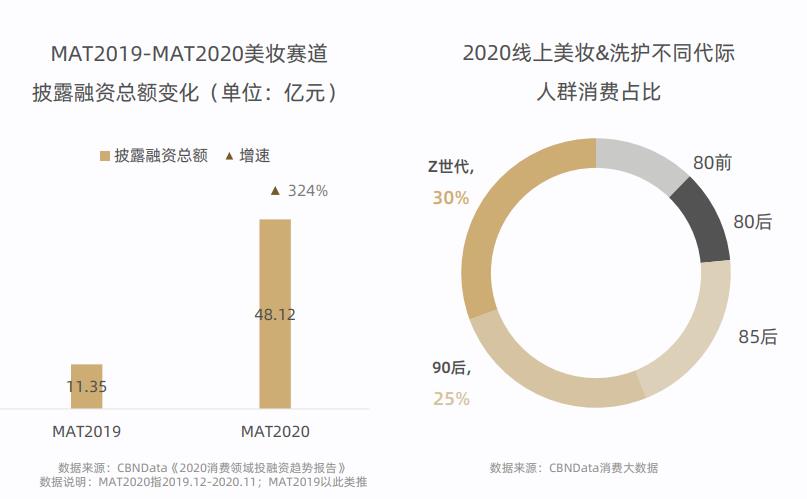

In addition to IPO, various funds have also poured into the domestic beauty industry. With the overall decline in the number of investment and financing events in the consumer sector, the number of investment and financing events in the beauty and skin care track will increase steadily in 2020. The favor of capital also proves from the side.The domestic beauty industry is entering the best development era.

In the iterative consumption ecology, the cutting-edge domestic beauty brands have seized the opportunity of the times to rise rapidly and explored an unprecedented way to attack. On April 13th,CBNData and Tmall Gold Makeup Awards were released.The way to attack Tmall’s domestic beauty products-2021 beauty industry trend insight report(Pay attention to Ali Research Institute and reply to "2021 Beauty Industry" to get the full text of the report)Based on CBNData consumer big data, we have an insight into the changing process of the era of domestic beauty, and summed up three major styles of counterattack of new domestic products.

Source: 2021 Beauty Industry Trend Insight Report

New brands rise strongly.

Domestic beauty cosmetics enter the 3.0 era.

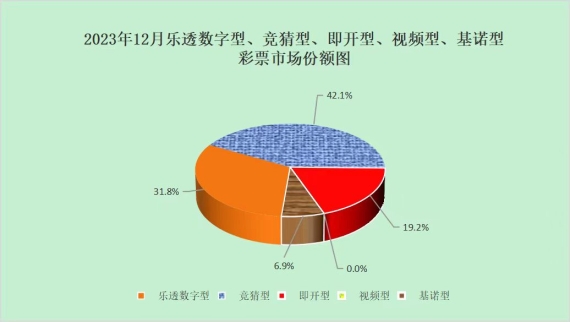

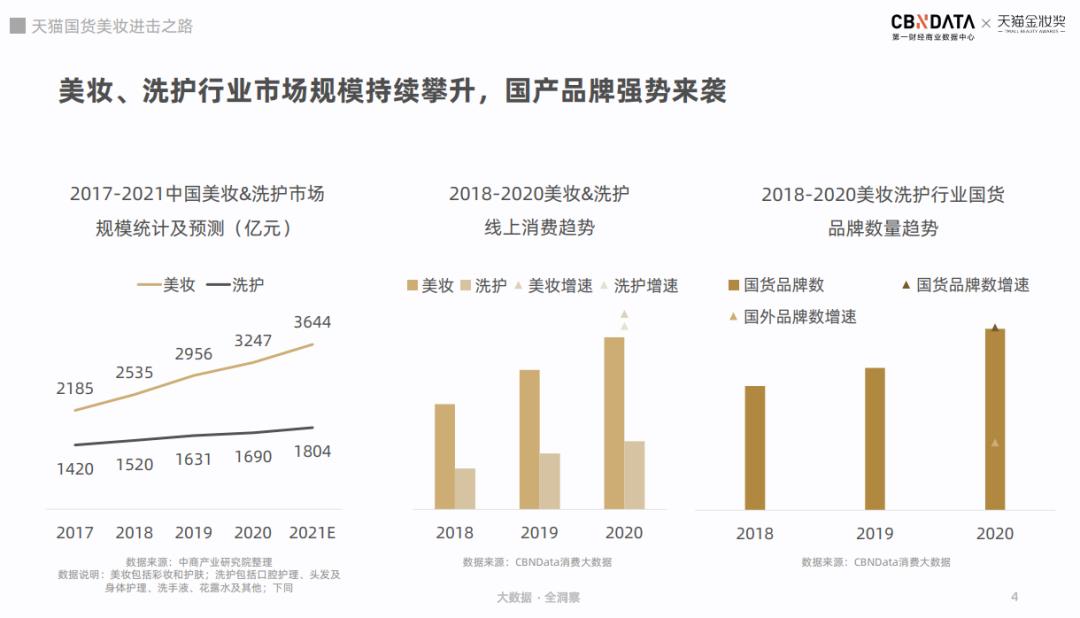

In recent years, the scale of beauty care market in China has continued to expand.According to CBNData Report, it is estimated that the beauty market in China will reach 364.4 billion yuan in 2021. From 2018 to 2020, the online consumption of beauty care has also increased year by year, showing a high growth rate, and the growth rate of beauty care is higher than that of care. At the same time,The number of domestic brands in the beauty care industry is also increasing rapidly. In 2020, the growth rate of domestic brands is much higher than that of foreign brands.

Source: 2021 Beauty Industry Trend Insight Report

Behind the rise of domestic products, on the one hand, it is the help of venture capital to the beauty track, on the other hand, the recognition of domestic products by young consumers is strengthened.According to CBNData’s "Report" data, in 2020, the beauty track disclosed a total financing of 4.812 billion yuan, with a growth rate of 324%, making it one of the hottest tracks in the venture capital market in the consumer sector.

From the consumer point of view, in 2020, the Z generation will account for over 30% of the online beauty care consumers. They are native netizens who have grown up with the mobile Internet. They have been influenced by multiculturalism since childhood, and their consumption attitudes are different from those of previous generations. They are more in pursuit of value recognition when choosing brands, and they also have stronger national self-confidence. Compared with big-name labels, they are more interested in high value and cost performance.

According to CBNData data, 40% of the dressing tables of generation Z are domestic brands.

Source: 2021 Beauty Industry Trend Insight Report

Looking back at the road of attack of domestic beauty, I actually experienced it.Traditional beauty cosmetics, "Amoy beauty cosmetics" and cutting-edge beauty cosmetics.Three times. In the era of domestic product 1.0 before 2012, Ding Jiayi, herborist, Kazilan and other traditional domestic beauty and skin care brands reached consumers through traditional CS channels and communicated with consumers through mass media.

In 2012-2014, domestic beauty products entered the 2.0 era with the development of mobile Internet, and "Amoy Beauty Products" brands such as Royal Nifang, Afu Essential Oil and Mofashijia entered the fast lane of development with the help of the potential energy of e-commerce and the changes of users’ online consumption habits.

In recent years, from Perfect Diary, Huaxizi to colorkey, many new brands have seized the opportunity of new consumption. generate has shown great vitality, and domestic beauty cosmetics have entered the 3.0 era. According to the data,In 2020, the overall growth rate of the beauty industry will be 23%, while the growth rate of new beauty consumption will be as high as 78%.

Source: 2021 Beauty Industry Trend Insight Report

Three major styles of play

Open up the way to attack domestic beauty cosmetics

Although these cutting-edge domestic beauty products that rose in the 3.0 era have their own differentiated strategic layouts, they also have commonalities in "playing". CBNData’s "Report" summarizes the play of cutting-edge domestic products as follows"Online popularity, offline competition, sailing out to sea".

01

Online popularity:

Take advantage of the platform to play with young people

From cutting-edge domestic brandsFounder backgroundFrom the point of view, the founders of brands such as Huaxizi, Girlcult and colorkey are all brands founded by young people after 80 s and 90 s, and they know more about the changing new needs of young consumers.

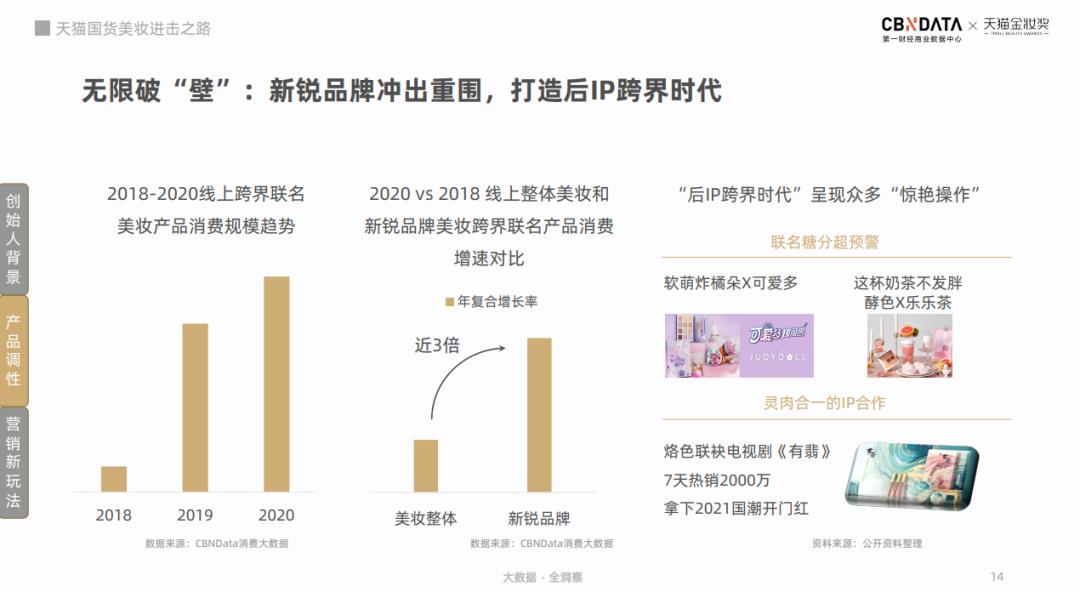

Product tonalityIn fact, cutting-edge brands generally pay more attention to products.appearance index, but also good at passingIP crossoverTo achieve the effect of breaking the circle. The data shows that the proportion of people who choose another product because of better packaging is three times that of previous generations.

From 2018 to 2020, the consumption scale of online cross-border joint-name beauty products has greatly increased, and the consumption growth rate of cross-border joint-name products of cutting-edge brands is nearly three times that of beauty products as a whole.

Source: 2021 Beauty Industry Trend Insight Report

And inMarketing playIn fact, cutting-edge brands have a keen insight into the catalytic habits of young people, using Tik Tok, Xiaohongshu and bilibili.Content social platformWin the resonance of young users through scene and personalized content creation. In addition, many new domestic brands have also cooperated with Tmall Black Box and Alibaba Big Data.Tmall platformUnder the depth of empowerment, explosives are created to achieve overtaking in corners.

Source: 2021 Beauty Industry Trend Insight Report

02

Offline "competing for deer":

Layout offline to enhance the consumer experience

2020 is also the year of the outbreak of beauty collection stores. From colorists and WOW COLOUR to plum blossom and happy burning, offline beauty collections have expanded against the trend. A cutting-edge brand that started online, throughSettle in the beauty collection store,Open up offline channels, bring makeup fitting services to consumers, and create a more complete and diverse consumer experience.

Source: 2021 Beauty Industry Trend Insight Report

In addition to entering the beauty collection store, the new domestic beauty products will pass after having a certain industry influence.Brand flagship store, concept store, pop-up shopIn the form of offline stores, tell brand stories and communicate with consumers more accurately and deeply.

Source: 2021 Beauty Industry Trend Insight Report

03

Sail out to sea:

Relying on the platform to enter overseas markets

As far as domestic cities are concerned,Guangzhou ranks first in the list of new domestic beauty cities.Perfect Diary, Ximuyuan, colorkey and other domestic beauty brands were all born in Guangzhou. According to CBNData Report, cosmetics manufacturers in Guangzhou account for nearly 40% of the country, which can be said to be a veritable beauty supply chain base.

Source: 2021 Beauty Industry Trend Insight Report

And looking overseas,The new favorites of domestic products in the beauty industry have also entered overseas markets.According to the data of the General Administration of Customs, in the first three quarters of 2020, the export volume of cosmetics in China was 752,500 tons, and the export value reached 3.139 billion US dollars, up 13.2% year-on-year. Tmall Taobao Overseas 2020 double 11 is a hot "preemptive purchase", and domestic beauty products have increased by more than 10 times. Among the beauty products that go out to sea, lipstick, eye shadow and blush are the most popular categories, while mascara and powder cake have great development potential.

Source: 2021 Beauty Industry Trend Insight Report

Domestic beauty brands have their own unique tricks in "going out to sea", or relying on Tmall Taobao Overseas and Amazon.E-commerce platform salesGo around the world; Or buildOverseas official website, open official accounts of overseas social platforms and establish more contacts with overseas consumers; Or byAcquisition of international brandsLayout overseas markets with high-end routes.

With the iterative upgrade of social media platform and e-commerce platform, a large number of cutting-edge domestic beauty products have reconstructed the original consumption link and quickly established the brand’s influence among consumers; The offline layout provides consumers with a more personalized service experience; The new wave of domestic brands of beauty products going to sea is not only the layout of each brand strategy, but also proves the strength of China brand to the world.

Editor: Binka (please leave a message in the message area for reprinting and media cooperation)