[Text/Observer Network Chen Sijia] The impeachment draft against Trump has been passed in the US House of Representatives, and Trump has become the first president in American history to be impeached twice.

Although some Republican congressmen tried to defend Trump on the grounds of insufficient evidence and asked the House of Representatives to find witnesses to prove Trump’s "sedition", Washington post pointed out in a report on the 13th that demonstrators said that they came to Washington at Trump’s request.

However, some legal experts and American media also pointed out that Trump’s own speech before the riots was the decisive factor. Legal experts pointed out that no matter what the demonstrators thought, Trump did know that someone was trying to create violence but did not stop it. Instead, he made a suggestive speech. They believe that Trump is likely to use the First Amendment to defend himself and try to interpret his words as "rhetoric that is not literal".

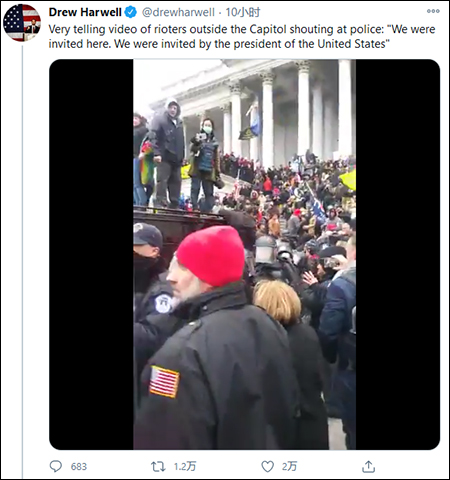

"Republican congressmen want to incite evidence, and there are several thugs who came to the capital because of Trump.",screenshot of Washington post report.

Demonstrators "sell" Trump?

Before the congressional riots on January 6, Trump made a speech outside the White House, calling on the people to March peacefully and "fight" on his behalf. The article emphasizes that the behavior of demonstrators attacking the capitol did happen after this speech, but there is also no evidence to prove that this speech prompted the demonstrators to do so.

But the problem is that many materials or testimonies from Trump supporters show that the demonstrators rushed to Washington, D.C. to launch this rally in response to Trump’s call, which is closely related to the subsequent riots.

Drew Harwell, a journalist from Washington post, posted a video of demonstrators gathering outside the Capitol on Twitter. He said that the video was taken from the social media Parler, and some demonstrators could be heard shouting "We were invited, we were invited by the President of the United States".

Javier Twitter screenshot

The arrested demonstrators have also "betrayed" Trump in disguise, and the first one is the "Tauren Shaman" who made a splash in the riots.

According to the report, this "tauren shaman" named Jack Angeli, also known as Jacob Chansley, has been arrested by the police. After he went to prison, he told the US police that he and other "patriots" from Arizona "came to Washington, D.C. on the 6th at the request of the President".

Angeli, the "Tauren Shaman" who broke into Congress, from: 澎湃 image.

Douglas Sweet, another demonstrator who was arrested, told WTKR TV in Virginia that he went to Washington only because "Trump asked all patriots to be present, so he went".

Larry Brock, an air force veteran, rushed into the Capitol building with a guy, and was quickly arrested and charged by the US police. Other demonstrators also gave the same statement when interviewed by the US media. Brock said, "The president invited his supporters to attend, which I think is very important, because I love my country so much, so I went there." He also claimed that he thought he was "welcomed into the Capitol".

The report pointed out that these people did not testify in the House of Representatives, proving that they were incited by Trump to attack the Capitol, but they all admitted that they came to Washington, D.C. at Trump’s instigation and finally broke into Congress with the crowd.

Washington post speculated that these people should be referring to many tweets sent by Trump in the past month. Since mid-December last year, Trump has repeatedly announced that there will be a "large-scale protest" in Washington on January 6, the day when Congress certifies the results of electoral votes, and he repeated this point many times on January 1.

Is the charge of "sedition" established?

Although there are many similar live videos and testimonies, it is Trump’s own words that ultimately play an important role in the impeachment case. Garrett Epps, a law professor at the University of Baltimore, said in an interview with the British Broadcasting Corporation (BBC) that a few words he said in his speech before the congressional riots would have a very negative impact on Trump.

BBC report screenshot

Epps pointed out that one of the important arguments that the Democratic Party accused Trump of "inciting rebellion" was Trump’s repeated "election fraud". Trump has been shouting this slogan for more than a month. He shouted this slogan and called for supporters to gather, and continued to repeat this slogan before the congressional riots.

Another phrase he often said, "Stop stealing votes," became an important label for Trump to echo this demonstration. Since November last year, Trump has shouted "Stop stealing votes" many times and has already triggered demonstrations related to it in many places in the United States.

The statements included in the impeachment draft by the Democratic Party also include "We will never give up and never compromise", "If you don’t fight hard, the country will not be a country" and "We will go to the Capitol". Epps said that these remarks can be completely regarded as inciting supporters to go to the Capitol to create violence, and it is difficult for lawyers to provide Trump with a strong defense on these statements.

Epps said that for Trump, the key is whether he can defend himself with the First Amendment to the US Constitution. The amendment only criminalizes inflammatory statements that meet certain standards, and such statements must have the intention of causing violence or may lead to violence.

Reuters also pointed out that Trump’s likely strategy is to invoke the First Amendment as a shield of "freedom of speech" and try to interpret "fighting" as a kind of rhetoric, saying that his intention is "not violence in the literal sense".

On the 6 th, Trump gave a speech to the demonstrators, from: 澎湃 image

However, epps concluded that on the whole, the trial was more unfavorable to Trump. He obviously knew that some people in the crowd were planning to engage in violent activities, and he not only failed to take measures to stop this behavior, but also made a series of suggestive speeches. But epps can’t say for sure what the result will be. He thinks it may depend on the jury’s thinking.

On the 12th, Trump made his first appearance after the riots in Congress, defending his speech, saying that his speech was "completely appropriate". The US media believes that this shows that Trump has no responsibility for the riots in Congress and has no regrets.

The first president to be impeached twice.

On the afternoon of January 13th, local time, the US House of Representatives passed the second impeachment case against Trump with 232 votes in favor and 197 votes against, and the charge was "sedition". This also made Trump the first president in American history to be impeached twice.

According to the impeachment procedure, after the House of Representatives passes the impeachment draft by a simple majority vote, the Senate will examine and debate the charges. The impeachment case can only come into effect when it is supported by two-thirds of senators in the Senate.

Schumer, the minority leader of the Senate, hopes to reach an agreement with McConnell, the majority leader of the Senate, to start the impeachment procedure immediately, but McConnell said that the Senate will not start the trial procedure until the 19th. This means that the trial of Trump’s impeachment case may not be completed until Biden officially takes office.

Shortly after the House of Representatives passed the impeachment case, Trump responded by delivering a video speech. He once again condemned the riots in Congress, saying that the people involved in the attack were not his "real supporters". But Trump did not comment on impeachment. Earlier, Trump had criticized impeachment as "very dangerous to the United States".

Impeachment may not affect Trump’s last week in office, but The New York Times has previously pointed out that if Trump is found guilty, the Senate can ban Trump from holding public office or even disqualify him from running for president again. Since Trump is likely to move to the 2024 US presidential election, impeachment is an attractive option for some Republicans who are interested in competing for the presidency.

This article is an exclusive manuscript of Observer. It cannot be reproduced without authorization.