On April 15, the market fluctuated and rebounded all day, and the three major indexes all rose more than 1%. The trend of size index is obviously differentiated,The index fell more than 9%, and more than 500 shares fell more than 9%.

At the close, the Shanghai Composite Index rose 1.26%, the Shenzhen Component Index rose 1.53% and the Growth Enterprise Market Index rose 1.85%.

In terms of plates,、、, high dividends and other sectors were among the top gainers., gold, environmental protection, tourism and other sectors were among the top losers.

On the whole, individual stocks fell more and rose less, with more than 4,000 stocks falling in the whole market. The turnover of Shanghai and Shenzhen stock markets today was 997.1 billion, 341.2 billion more than the previous trading day.

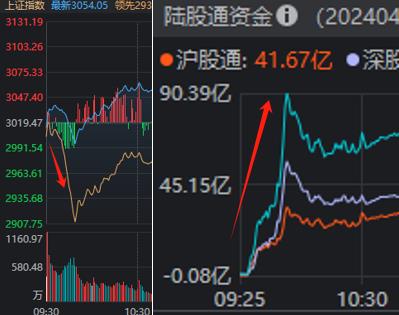

Northbound funds bought a large net of 8.108 billion yuan throughout the day, and the net purchase amount in a single day reached a one-month high; amongThe net purchase was 3.892 billion yuan,The net purchase was 4.216 billion yuan.

Today’s A shares,Although not everyone can make money, most people must have been shocked..

The so-called "shock" must be a rare sight at ordinary times. Today, we have witnessed the history of A shares:

1) In early trading, the Shanghai Composite Index once fell below 3,000 points, but it soon went to V, and the highest rose to 3,066.94 points, which was shocking;

From 9:30 to 9:50, that is, the most thrilling decline today, northbound funds were bought "impersonally", and the net purchase amount in 20 minutes was as high as about 9 billion yuan, which greatly reversed the market sentiment and was also very shocking.

2) off the charts, a daily limit stock, reached 336 at most and 317 at the close. Since this wave of rebound on February 6, it has rarely happened, which is shocking;

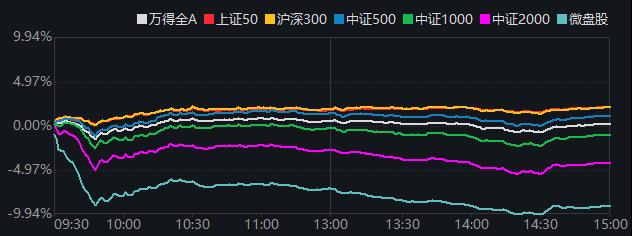

3) If the market value of A-share stocks is ranked from small to large, you will find that:On the one hand, there are small and micro-sized stocks that have almost fallen, and on the other hand, there are large-cap stocks that are all red.-Isn’t this picture shocking?

Combined with the above analysis, today’s A shares may reveal an important change signal-the spring of leading stocks with excellent performance is coming. Let’s look at it specifically.

ST plate, small limit tide

In fact, in the short-term elves at 9:25 in the morning, the large-scale limit of ST stocks has hinted that today’s disk is very unusual.

Obviously, this is closely related to the Opinions on Strictly Implementing the Delisting System issued by the CSRC on April 12. The document proposes that through strict delisting standards, efforts should be made to clear "zombie empty shells" and "black sheep" and reduce the value of "shell" resources; At the same time, broaden diversified exit channels and strengthen investor protection of delisting companies.

Moreover, the short-term negative effect of this "strictest delisting new regulation" has also spread to those small-cap stocks that are poorly managed and do not have growth.

At the close, a total of 317 stocks in the whole market fell, including 76 ST stocks; In addition, the other 241 down-limits are mainly non-ST small ones.

Short-term even board market is also affected. The most popular cyclical stocks last week fell into collective adjustment today.、Waiting for many popular stocks to fall, but、And other stocks still show strong strength in the session; at-the-close orderStep out of the sky floor.

According to Wind data, as of the close, the performance of CSI 2000 and micro-disk index was obviously weak, and the overall performance of Wande micro-disk index fell by nearly 9%.

On the other hand, the average share price of All-A shares fell by 2.08% today, indicating that heavyweights dominated the rising side.

High dividends ushered in an outbreak.

Throughout the day, high dividend assets were active. Indexes such as CSI A50, CSI 300 and dividend index, which represent the core assets of A shares, led the gains.

In the prefix plate,Put a huge daily limit in the morning,Continue to hit a new high in the past 10 years. According to the latest announcement, the company expects to achieve a net profit attributable to shareholders of listed companies of 923 million yuan to 1.046 billion yuan in the first quarter of 2024, a year-on-year increase of 50% to 70%.

It is worth noting that when the Shanghai Composite Index dived and turned green in early trading, FTSE China A50 index futures did not dive, while northbound funds continued to flood into the bargain-hunting.

From the perspective of contribution, from 9:50 to 10:30, in the unilateral upward segment after the Shanghai Composite Index bottomed out, the Chinese prefix stock contributed the most.

It said that the new "National Nine Articles" was released, and "Bonus+"ushered in a long-term valuation reshaping. Referring to overseas experience, after the dividend policy was defined in Japan’s Company Law in 2005, the dividend rate of listed companies increased greatly, and its "dividend+"industries were divided into two categories:

One is the traditional high dividend with a significantly outperformed dividend yield, which is mapped to A shares including electricity, operators, coal, etc.

The other category is the potential high dividend of consumer products with moderate overall dividend level but great internal differentiation, which is mapped to A shares, including home appliances, some mass goods, clothing and home textiles. When the second type of overseas enterprises raise dividends, the excess return is more closely linked to the marginal change of free cash flow.

It is said that high dividends are becoming a trend of thought, and the management’s promotion of the rule of law in the capital market resonates with market preferences (large-scale warehouse assets), corporate governance optimization trends (high-quality governance, high-quality returns, high-quality mergers and acquisitions), or clues to the next wave of trends.

In addition to the Chinese prefix, the brokerage sector also took the initiative today, and the increase was ahead of the close. However, the fly in the ointment is that the performance of large-cap leading stocks in the sector is average, which will lower the expectation of short-term follow-up to some extent.

According to the open source research report, the new "National Nine Articles" highlights strict management and strong foundation, and emphasizes investor protection, which is in line with the current development stage and major contradictions of the capital market and is conducive to enhancing market attractiveness from the source. It is emphasized that brokers will put functionality in the first place, investment banking and wealth management capacity building will be the focus in the future, and the industry concentration will be accelerated under the guidance of strict supervision and creating high-quality head brokers.

Is it spring for blue chip stocks?

It is not difficult to see that although more than 4,000 stocks fell today, the index performance is not weak due to the general strength of heavyweights.

However, if you think that this is just a common situation of "rising the index without rising individual stocks", you may have missed some important signals.

At least in the similar structured market in the past, there will not be so many stocks falling below the limit; It is also difficult for the stock index to close when there are so many stocks falling.

Therefore, feeling that "things are changing" is very important for everyone to adjust their subsequent investment strategies.

It is said that the implementation of the new "National Nine Articles" has laid a solid foundation for the long-term and healthy development of China’s capital market, and the strategic allocation value of dividend strategy is increasing in both short-term and long-term investment dimensions. The framework of the new round of "1+N" policy system in the capital market has gradually become clear, and the focus of reform has shifted to the investment side, focusing on improving the quality of listed companies and investors’ returns, and consolidating the important foundation for the long-term healthy development of China’s capital market. The short-term policy is more conducive to the market style and dividend strategy.

It is believed that if the follow-up policies are further implemented, with the disclosure of the annual report and the performance forecast of the first quarterly report, the performance stabilization of the excellent sector and the leading companies in various industries will be verified, and the improvement of free cash flow brought about by the downward capital expenditure will be further confirmed. The listed companies as a whole will increase the dividend ratio, which will make the leading companies with excellent A shares bring real returns to investors, and the leading index with excellent performance is expected to be dominant.

A shares rose sharply on the first day of the new "National Nine Articles"! Can we repeat the bull market?

A shares have changed dramatically! Rush to the hot search! The Chinese prefix is stronger, and the big financial sector broke out collectively.

Is the spring of heavyweights back? Nearly 4,000 shares of floating green SSE 50 rose against the market and "Chinese prefix" strengthened.