On Thursday (November 16th), the three A-share indexes weakened collectively, with a total turnover of 850.7 billion yuan in the two cities, shrinking by 139.3 billion yuan from the previous trading day. As of the close,Down 0.71%,Down 1.23%,It fell by 1.85%.

In terms of plates,、, photoresist, etc. are among the top gainers; BC、, optical modules, etc. were among the top losers.

01

Many foreign investors expressed optimism.

On Thursday, the market failed to hit the 3080 resistance level, which was an important support level in the early stage. After falling below it, it formed an important counter-pressure level, and it was also a 60-day moving average. It was not easy to stand up effectively at once.

UbsChina’s stock strategyLei Meng said that since the third quarter, China’s national debt, yield to maturity, has rebounded, and the commodity price index has also rebounded, indicating that they may be pricing China’s macroeconomic rebound.

"The positive impact brought by the continuous efforts of policies will continue to be reflected, and A-share earnings are expected to continue to rebound in the next six months, thus driving the A-share market to usher in repair." Lei Meng said.

It is believed that although the A-share market has rebounded obviously in the past few weeks, this is only a repair of the previous oversold, and the subsequent A-shares are still worthy of optimism. In the investment direction, the fund said: "We are optimistic about the technology sector that really benefits from the rapid development of the AI industry, the high-end manufacturing sector with a high level of prosperity and continuous overweight policies, andMedicine and other sectors with steady growth rate. "

02

The 6-board demon suddenly fell.

In the case that the market wind was suppressed on Thursday, the old hot.I began to show fatigue. I walked out of 6 days and 6 boards before.Conceptual bibcockOn Thursday, it suddenly fell below the limit, with more than 20,000 orders closed, and the turnover exceeded 600 million yuan, with a cumulative decline of over 15% in the past two trading days.

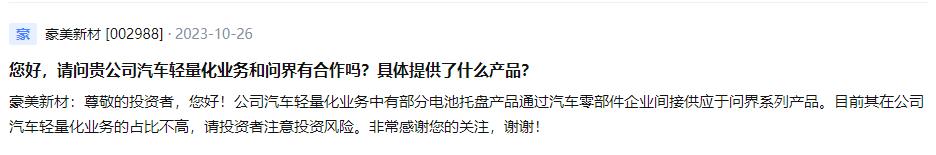

On October 26th, on the interactive question-and-answer platform, it was indicated that some pallet products in the company’s automobile lightweight business passed.Enterprises indirectly supply series products to the world. At present, its proportion in the company’s automobile lightweight business is not high, so investors should pay attention to investment risks.

Since then, the company’s share price began to change, and it closed up 7.6% on October 31. Since then, although it has been mixed, the bottom has been rising. On November 7, a word board suddenly appeared, and after six trading days, it went out of six consecutive boards, with a cumulative increase of over 77%.

03

"soul torture" in Shenzhen Stock Exchange

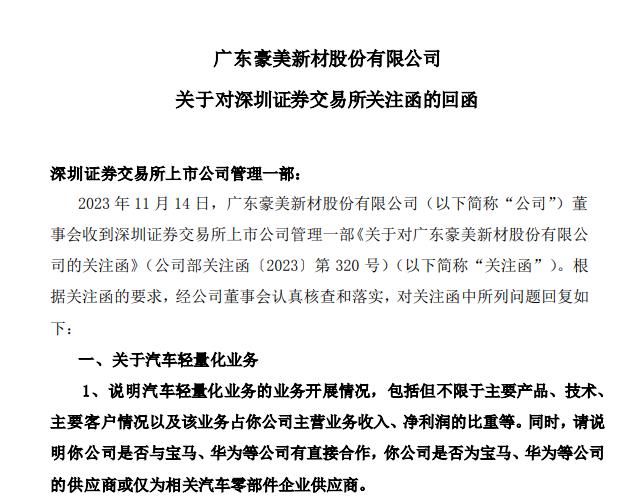

The stock price change has also attracted regulatory attention. On November 14th, Haomei New Materials received a letter of concern from Shenzhen Stock Exchange, which focused on automobile lightweight business.

Shenzhen Stock Exchange requires the company to explain the business development of automobile lightweight business, and at the same time explain whether the company has direct cooperation with BMW, Huawei and other companies, whether it is a supplier of BMW, Huawei and other companies or only a supplier of related enterprises.

On November 15th, Haomei New Materials stated in the reply letter that the company’s current automobile lightweight business mainly includes pallets, anti-collision beams and sub-frames.Materials and components of components, shock-absorbing brackets, power brackets and other products, among which battery tray and anti-collision beam materials and components are the most important products.

In the above reply letter, Haomei New Materials stated that most of the lightweight materials and components provided by the company need to be processed and assembled by enterprises and then supplied to the OEM, and the company’s position in the supply chain is the second-tier supplier or the third-tier supplier of the OEM.

Haomei New Materials also said that BMW, Mercedes-Benz, Honda, Toyota, Guangzhou Automobile Aian mentioned in the investor relations record form,, Huawei Wenjie, Changan and other automakers are not direct customers of the company, and the company does not directly sell related products to the above automakers. The corresponding direct customers of the company are, casma,Such as auto parts enterprises, the related products supplied by the company need to be processed and assembled by the above-mentioned auto parts enterprises before they can be supplied to the automobile factory.

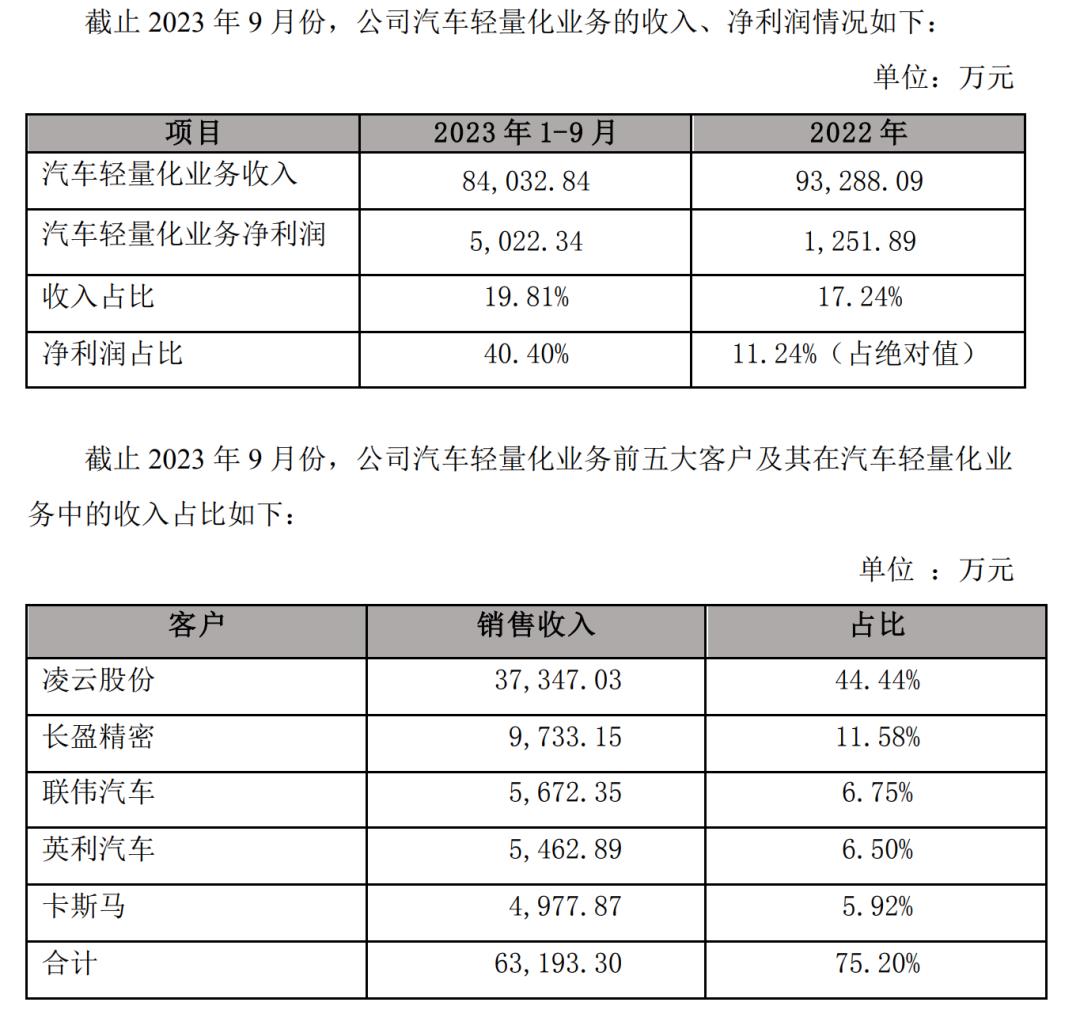

As of September, 2023, the revenue from the lightweight business of Haomei New Materials Automobile was 840 million yuan, accounting for 19.81%. Automobile lightweight business50,223,400 yuan, with net profit accounting for 40.40%. In contrast, in 2022, the revenue of automobile lightweight business was 933 million yuan, accounting for 17.24%; The net profit of automobile lightweight business was 12,518,900 yuan, accounting for 11.24%.

04

What does the boundary really contribute to geometry?

For the short-term funds in the market, we are more concerned about the order situation. Haomei New Materials said that for the series (Wujie M5 and M7), the company successively obtained the designated projects of M5 and M7 in September 2021 and March 2022, and the corresponding direct customers were parts enterprises, and the main products provided by the company were battery tray materials. The related materials produced by the company are processed into battery trays by the parts enterprises and delivered to the power battery enterprises, and then the power battery enterprises add batteries to form battery packs and deliver them to the automobile factory.

Haomei New Materials said that in the above-mentioned supply chain, the company is a third-tier supplier of the car factory.

At the same time, for the contribution of the order to the performance, Haomei New Materials said that in 2022 and 2023, the shipment amount (including tax) of Haomei New Materials to the series through parts enterprises was: 72.69 million yuan in 2022, accounting for 1.34% of the company’s total sales revenue; From January to September, 2023, the amount of indirect shipments to Wenjie series was 4.79 million yuan, accounting for 1.34% of the company’s total sales revenue in the same period; In October, 2023, the amount of indirect shipments to Wenjie series was 10.99 million yuan, accounting for 1.98% of the company’s total sales revenue in the same period.

Haomei New Materials specifically pointed out that the increase in the shipment amount in October 2023 compared with January-September 2023 was mainly due to the increase in the company’s shipments through parts companies after mass production of M7 in Wenjie.

05

"Cross-border" optical communication was also inquired.

In addition, Haomei New Materials previously disclosed that the company plans to cut into the field of optical communication.

According to the foreign investment disclosed on November 6,, Haomei New Materials plans to make a D round investment in Sols Optoelectronics at US$ 2.6179 per share, with an investment amount of US$ 40 million (about RMB 290 million according to the current RMB exchange rate).After the exercise, it acquired 15,279,400 shares of Sols Optoelectronics, accounting for about 5.79% of the shares of Sols Optoelectronics after the investment was completed. Haomei New Materials said that this investment in Sols Optoelectronics, the world’s leading supplier of optical communication components, will help the company share the opportunities brought about by the rapid development of optical modules.

This investment was also inquired by Shenzhen Stock Exchange, asking Haomei New Materials to explain whether to invest in Sols Optoelectronics to acquire its relevant equity or subscribe for its convertible bonds, the reasons and necessity of the company’s cross-border acquisition of assets in optical communication-related fields, and whether the company has the feasibility of the above-mentioned cross-border acquisition in terms of staffing, technology research and development, market development, etc., and whether there are speculative concepts and hot spots.

In this regard, Haomei New Materials replied that the investment in Sols Optoelectronics is due to its optimistic development prospects for the optical module industry. After the investment is completed, the company will not participate in the daily operation and management of Sols Optoelectronics. However, it should be noted that Haomei New Materials has no relevant reserves in personnel allocation, technology research and development, market development, etc. in the field of optical communication.

06

Hao mei Xin Cai:

Fierce game of hot money seats

Some market participants said that hot money speculation pays attention to a "hazy beauty", which is often referred to as the imagination space. After continuous pulling, there is an impulse to cash in at a high level, and the expectation of overlapping imagination is broken, and short-term funds naturally profit and flee.

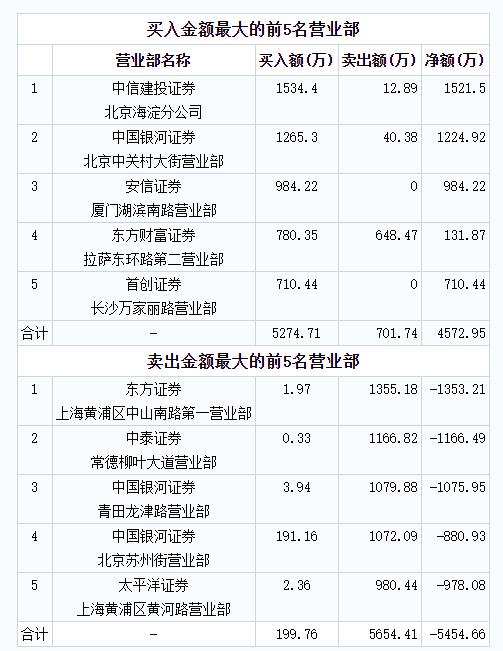

From the data of the Dragon and Tiger List on Thursday, the top five seats of Haomei New Materials Trading were dominated by the hot money business department. The net purchase of the top five seats was 45.73 million yuan, and the net sale of the top five seats was 54.55 million yuan.

Buy a seat forBeijing Haidian Branch, the seat bought 15.344 million yuan, sold 128,900 yuan, and the net purchase amount was 15.215 million yuan.

Buy two seats as well-known hot moneyBeijingStreet securities business department, the seat bought 12.653 million yuan, sold 403.8 million yuan, and the net purchase amount was 12.2492 million yuan.

Sell a seat forThe first business department of Zhongshan South Road, Huangpu District, Shanghai, bought 19,700 yuan, sold 13,551,800 yuan, and the net sales amount was 13,532,100 yuan.

07

Many popular linked stocks fell.

In addition to Haomei New Materials, there are many recent high-profile bull stocks on Thursday, such as、、Waiting for the intraday diving limit.

For example, the chip concept leader who recently walked out of the 7-board board quickly dived after the opening on Thursday, and closed at the end of the day. At the close, the stock reported 5.42 yuan, and the daily limit closed at 160,000 lots.

The company issued a risk warning on Wednesday night, saying that the current business situation is normal, the internal and external business environment has not changed significantly, and the company’s fundamentals have not changed significantly. Shenzhen Huangting Fund Management Co., Ltd., a wholly-owned subsidiary of the company, holds 27.8145% of the shares of Yifa Power, and the proportion of voting rights in Yifa Power is 85.5629% through concerted action agreement. From January to September, 2023, the intentional power was realized.136,802,700 yuan, accounting for 13.5% of the operating income of listed companies; Realized a net profit of-16,413,000 yuan, accounting for the ownership of listed companies.The net profit ratio is 3.21% (note: the above financial data are unaudited). At present, powerThe income and profit generated by the business account for a low proportion of the company.

In addition, the company’s net profit after deducting non-recurring gains and losses attributable to shareholders of listed companies in 2020, 2021, 2022 and the third quarter of 2023 are all losses. The company’s financial situation will not change greatly in the short term. Investors are advised to invest rationally and pay attention to the risk of performance loss.

The concept leader of short drama had gone out of 10 days and 8 boards before, and suddenly fell to a high limit on Thursday, sealing 14 thousand lots, with a turnover of 1.5 billion yuan.

In the announcement of the change, it is indicated that the company is holdingFor the partial equity of the media, the expected profit of the short drama business of the media (including Hippo Theater) in 2023 will not exceed 3 million, and the overall profit of the media company in 2023 will be pre-lost. The operation of China Radio and Television Media, a non-corporate financial consolidated statement enterprise, and Hippo Theater will not have a significant impact on the company’s operation, nor will it have a significant impact on the company’s financial situation. Investors are advised to pay attention to investment risks.

It is for investors’ reference only and does not constitute investment advice.